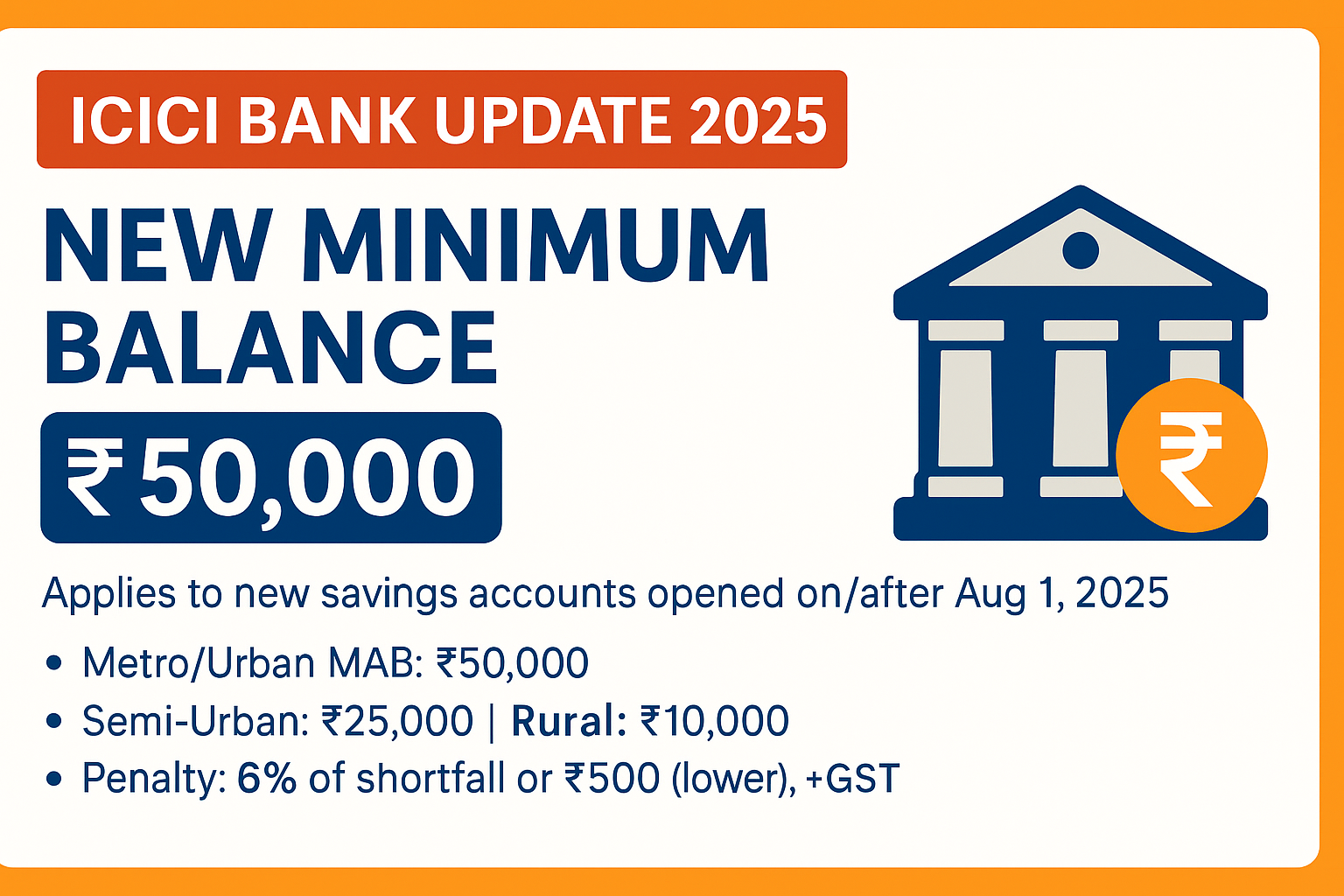

- Effective date: For new savings accounts opened on/after Aug 1, 2025.

- Old accounts: Continue with earlier MAB rules until further notice.

- Interest rate: Savings account interest remains 2.5% p.a.

New Minimum Monthly Average Balance (MAB)

| Location Type | New MAB (from Aug 1, 2025) | Earlier MAB |

|---|---|---|

| Metro / Urban | ₹50,000 | ₹10,000 |

| Semi-Urban | ₹25,000 | ₹5,000 |

| Rural | ₹10,000 | ₹2,000 |

Penalty, Exemptions & Benefits

Penalty for shortfall: 6% of the shortfall in required MAB or ₹500, whichever is lower, plus GST.

Exempted (Zero-Balance) accounts: Salary Accounts, PM Jan Dhan Yojana, and Basic Savings Bank Deposit Accounts (BSBDA).

Benefits for maintaining MAB: Free NEFT transfers, 3 free cash transactions/month; thereafter ₹150 per cash transaction (+ GST).

Quick Penalty Example

If your Urban account’s required MAB is ₹50,000 and your MAB in a month is ₹44,000, the shortfall is ₹6,000.

6% of ₹6,000 = ₹360 → compare with ₹500 → penalty = ₹360 + GST.

FAQs

Does this apply to existing ICICI savings accounts?

No. The revised MAB applies to accounts opened on/after Aug 1, 2025. Older accounts continue under previous MAB rules until ICICI Bank updates them.How is Monthly Average Balance (MAB) calculated?

MAB is the average of end-of-day balances for all days in the month: sum of daily closing balances ÷ number of days in that month.What if I switch branch category (e.g., move from urban to rural)?

The branch classification where the account is held determines the MAB. Ask the bank to confirm your branch category if you relocate or change branches.

Tags: ICICI Bank, ICICI Minimum Balance, ICICI MAB August 2025, Bank Penalty Charges, ICICI Savings Account, Zero Balance Accounts

#ICICIBank #MinimumBalance #MAB #ICICI2025 #SavingsAccount #BankCharges